Investors and traders now have a quick and easy way to evaluate the performance of individual stocks inside the S&P 500 index. It is possible only with the use of a new visualisation tool called the S&P 500 Heatmap. With the help of colour gradients and well-organized data, a heatmap may condense a large quantity of data into a compact manner.

This article will help you make better financial decisions by explaining the S&P 500 Heatmap and discussing its features and advantages.

How to Read a Heatmap

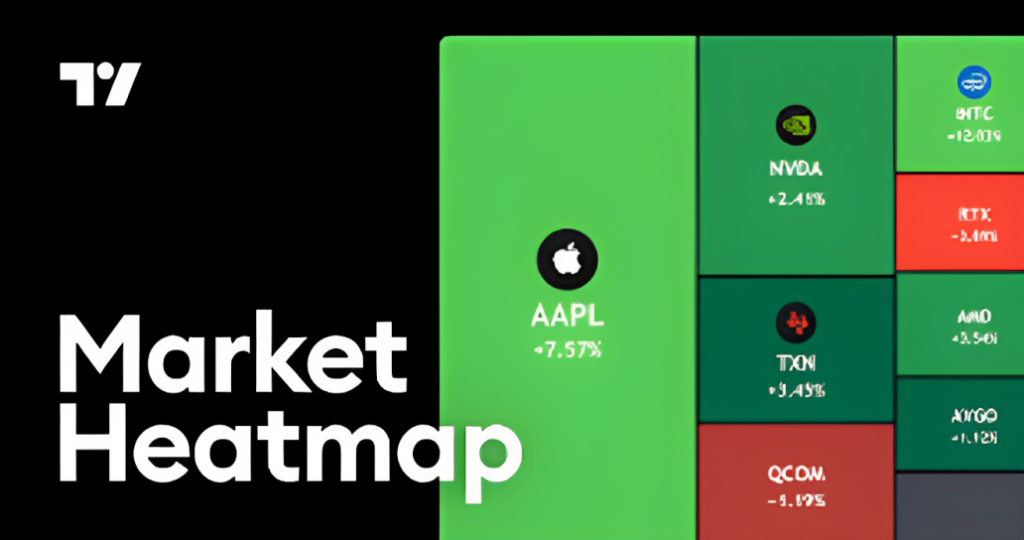

A heatmap is a kind of data visualisation that makes use of color-coded cells to show otherwise obscure information.

Each cell in the S&P 500 Heatmap denotes one of the 500 stocks that make up the index. Moreover, Each stock’s performance is color-coded by cell, so it’s easy to see which ones are doing well and which ones aren’t.

In what way is the Heatmap Structured?

Stocks are typically presented in alphabetical order in the S&P 500. Heatmap, with rows indicating different time periods and columns representing different industries.

Rows represent each day of trade, while columns represent individual stocks. Users are able to monitor stock performance over time and compare equities using this layout.

Varying degrees of colour inside the heatmap cells represents the Stock price fluctuations. Moreover, a colour gradient from green to red represents performance. Colour intensity is proportional to the magnitude of the price movement. Also, making it simple to spot shares that are doing extraordinarily well or poorly.

The S&P 500 Heatmap Advantages

Investors may rapidly assess performance by identifying the best and worst performing stocks. By using the heatmap, which provides a visual snapshot of market performance. The heatmap is a quick and easy approach to assess the market without having to sift through mountains of data.

Color Grading

The heatmap’s clean design and use of colour gradients make it a powerful tool. For tracking stock market movements and spotting patterns. Clusters of the same colour allow investors to quickly and easily see whether a given sector or industry is gaining or losing steam. This data can aid investors in making educated judgements and better allocating their resources.

Portfolio Holdings

Investors can use the S&P 500 Heatmap to conduct a thorough study of their portfolio holdings. Investors can determine if their portfolio is outperforming or underperforming. Only by comparing the performance of individual stocks to that of the market as a whole.

Performance Analysis

Since the S&P 500 index tracks companies across a wide range of industries, this heatmap is a useful tool for analysing sector performance. This knowledge can be useful for sector rotation or theme-based investing.

Conclusion

In sum, the S&P 500 Heatmap is a powerful resource that streamlines the process of assessing the state of the market.

Its color-coded design makes it easy for investors to analyse stock prices, spot patterns, and appraise their holdings. The heatmap equips investors with the ability to make better judgements. Also to keep pace with the ever-changing and fast-paced financial markets by utilising the power of data visualisation.

38 Comments

atorvastatin order purchase lipitor generic order lipitor 20mg pills

brand finpecia forcan online buy diflucan 100mg us

order cipro generic – how to get myambutol without a prescription augmentin online

buy ciprofloxacin 1000mg pill – buy cipro sale augmentin 625mg pill

cheap metronidazole – order terramycin 250mg pills azithromycin pills

purchase ciplox generic – order generic tindamax 300mg order erythromycin online

buy valtrex no prescription – how to get diltiazem without a prescription acyclovir over the counter

ivermectin 12 mg tablets for humans – buy sumycin no prescription tetracycline pills

buy metronidazole 400mg – order flagyl generic zithromax drug

brand furosemide – brand prograf buy captopril generic

acillin tablet order penicillin without prescription buy generic amoxicillin online

retrovir 300 mg over the counter – buy cheap generic avapro order zyloprim 300mg sale

buy metformin 1000mg generic – bactrim 480mg pills purchase lincomycin without prescription

quetiapine generic – buy quetiapine 100mg pills where to buy eskalith without a prescription

clozaril 100mg usa – frumil 5 mg ca order pepcid 40mg online

order generic atarax 10mg – buy generic pamelor 25 mg endep 10mg over the counter

anafranil sale – amoxapine us sinequan 75mg sale

amoxil cost – buy cephalexin generic where to buy baycip without a prescription

augmentin 375mg generic – buy bactrim medication baycip cost

buy cleocin 150mg for sale – monodox canada buy generic chloromycetin over the counter

buy azithromycin 500mg for sale – floxin where to buy purchase ciplox pills

buy albuterol without a prescription – purchase promethazine online buy theophylline 400 mg generic

stromectol tablets uk – buy aczone without a prescription buy cefaclor 250mg without prescription

desloratadine over the counter – aristocort 10mg price ventolin online

methylprednisolone 4mg without a doctor prescription – montelukast 10mg brand order azelastine 10ml generic

brand micronase – buy pioglitazone generic buy forxiga online

buy prandin 2mg generic – buy empagliflozin 25mg pills generic jardiance

order generic glucophage – losartan without prescription precose generic

lamisil 250mg canada – buy lamisil 250mg online buy griseofulvin pills for sale

order nizoral 200 mg without prescription – nizoral us buy sporanox 100mg pill

order rybelsus generic – how to buy semaglutide DDAVP medication

digoxin buy online – irbesartan 150mg oral buy furosemide generic

cheap famvir 500mg – buy acyclovir 400mg for sale oral valaciclovir 1000mg

buy microzide generic – buy hydrochlorothiazide generic buy zebeta without prescription

buy generic nitroglycerin over the counter – buy lozol buy diovan medication

generic lopressor – buy generic benicar over the counter buy nifedipine 30mg online

CBD exceeded my expectations in every way thanks. I’ve struggled with insomnia in the interest years, and after demanding CBD like [url=https://www.cornbreadhemp.com/blogs/learn/cbd-gummies-dosage-guide ]dose of cbd gummies for sleep[/url] because of the prime time, I at the last moment experienced a loaded night of restful sleep. It was like a weight had been lifted misled my shoulders. The calming effects were merciful still scholarly, allowing me to drift free logically without feeling groggy the next morning. I also noticed a reduction in my daytime desire, which was an unexpected but allowed bonus. The partiality was a bit rough, but nothing intolerable. Whole, CBD has been a game-changer inasmuch as my sleep and uneasiness issues, and I’m appreciative to procure discovered its benefits.

order crestor 20mg pill – crestor pills discover caduet susan